Budget Development and Strategic Plan Refresh Updates Shared

Montgomery ISD leaders hosted a town hall meeting tonight, to provide updates about the district’s 2024-25 budget development process and the refresh of the MISD Pathway to Premier Strategic Plan.

“After four special called sessions of the 88th Texas Legislature, no new educational funding legislation was passed. With no additional funding provided by the state, not even a mechanism to account for historic levels of inflation, we knew it would be an extremely difficult fiscal year for MISD. Legislative actions did bring about welcomed changes for our stakeholders such as an increased homestead exemption and tax compression. But even as the MISD tax rate fell 18 cents last year, Montgomery ISD still finds ourselves significantly underfunded in comparison to districts around the state,” MISD Superintendent Dr. Mark Ruffin said. “All the higher costs our families are experiencing at places like the grocery store, the gas station, utilities for your home – school districts feel those increases too.”

In Montgomery ISD, 85 percent of the budget is allocated to staff salaries and benefits. The district receives funding from three sources: Local property tax, state revenue and federal dollars. Local property tax collections fund approximately 75 percent of the budget.

LOCAL FUNDING

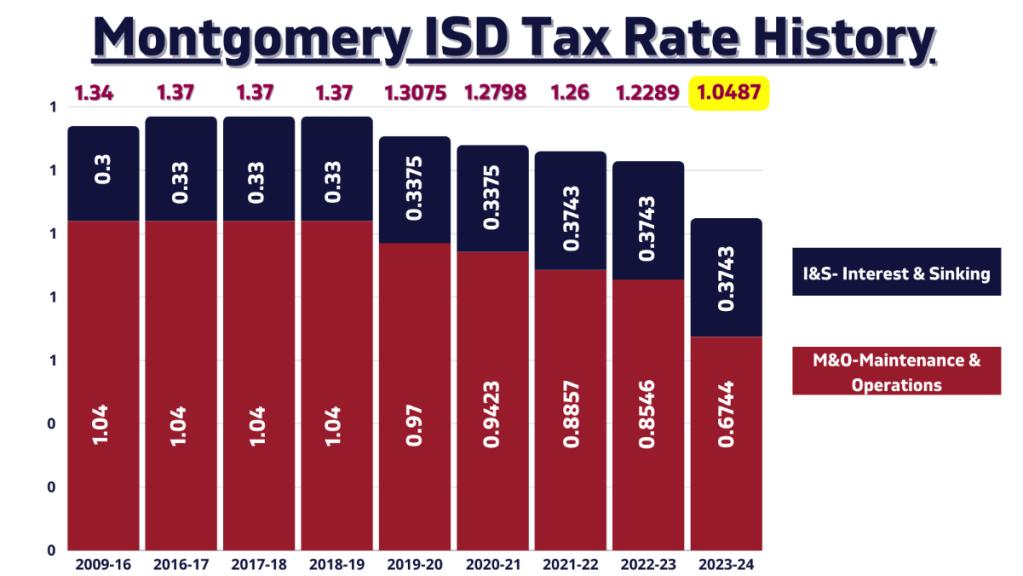

Each year, the district adopts two tax rates, Maintenance & Operations (M&O) that funds salaries, supplies, utilities – all the things needed for day-to-day operations, and Interest & Sinking (I&S) that pays the debt on voter-approved bonds that fund facility construction and renovations, land acquisition, and buses.

Montgomery ISD’s tax rate adopted by the board for trustees for 2023-24 was a historic low, $1.0487 per $100 property valuation, an 18 cent decrease from the previous tax year.

The 2023-24 tax rate represented the largest decrease to the district’s rate since 2006 when all school district property tax rates in Texas were decreased by $0.50. Also, for 2023-24, no increase to the district’s I&S tax rate was necessary or adopted, despite the district communicating the need for a small increase as part of the 2022 bond program.

STATE FUNDING

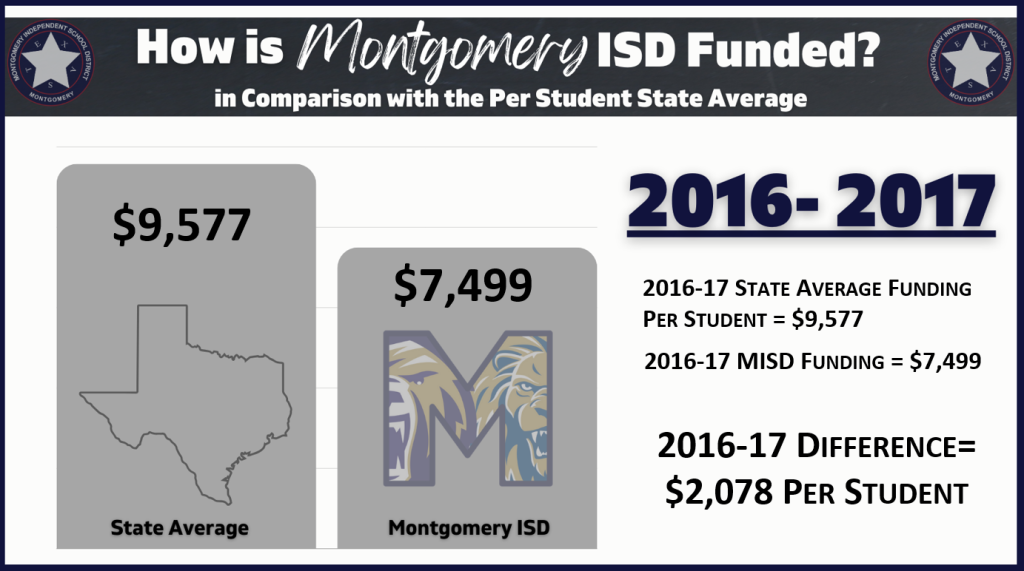

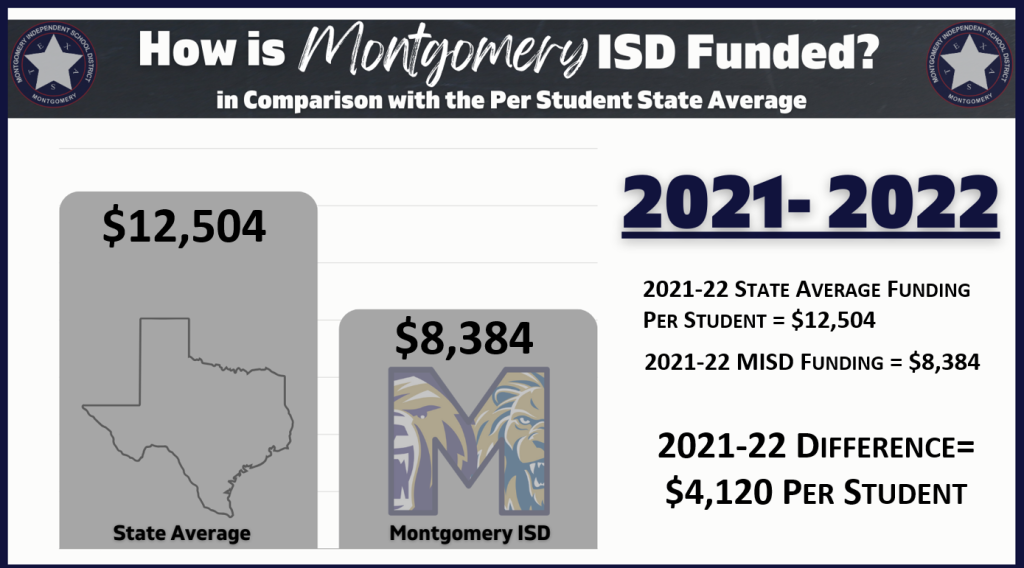

MISD continues to be funded at a level significantly less than the state average. The gap between MISD per-student funding versus the state average has increased since 2016:

If Montgomery ISD was funded at the state average, $4,000 additional dollars per student x 10,000 students would translate to approximately $40M. This additional funding would allow the district to eliminate the salary gap between MISD employees and those in surrounding districts, reduce class sizes, increase course offerings, academic programs, and increase campus support and safety personnel.

RECAPTURE

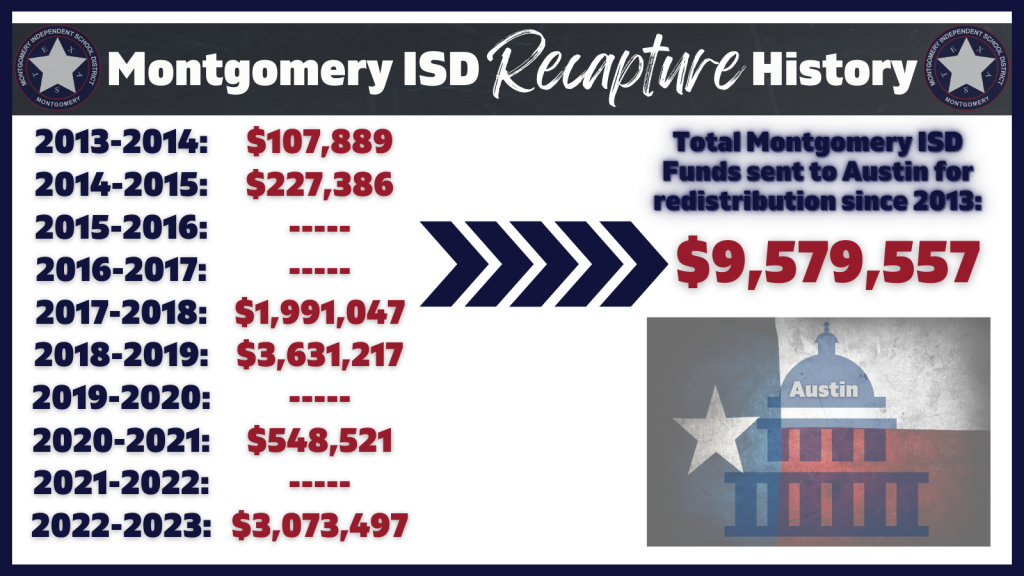

For the 2022-2023 school year, MISD returned to the state over $3M in recapture. This system, often referred to as “Robin Hood” requires property-wealthy school districts like Montgomery ISD to give money back to the state to be redistributed to other districts.

Over the past ten years, MISD has paid almost $10M in recapture:

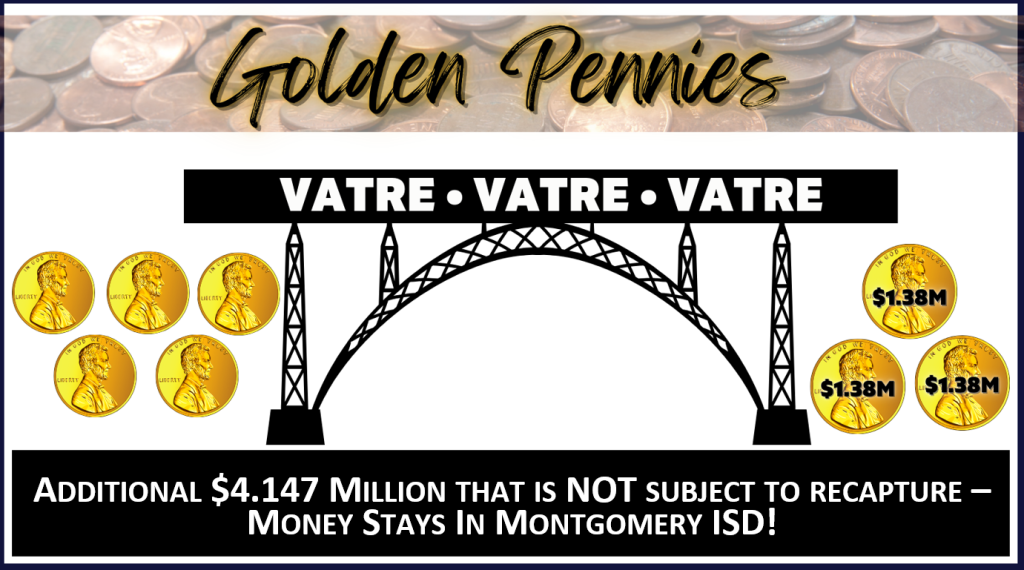

A question the district often hears is, “How can we keep our money in MISD?” The reduction in property tax rates and increase in homestead exemption should reduce the frequency of recapture for MISD. There are available funding options that would only become available through a Voter Approved Tax Rate Election (VATRE). A VATRE is an election required by the state that asks voters to consider approving a modified tax rate to increase revenue for student programs and teacher and staff salaries.

Public school funding allows a district to access 8 “golden pennies.” Taxes collected through these pennies are not subject to recapture. Currently MISD is only accessing 5 golden pennies, meaning an additional 3 are available. Each additional golden penny equates to $1.38 million in additional funding. It is imperative to understand that this additional $4.1 million in funding, that would stay in Montgomery ISD, is only accessible through a tax rate election. MISD has never requested voters to consider approving a tax rate election. Therefore, this opportunity for LOCAL control of our funding has not been operationalized.

COMPENSATION

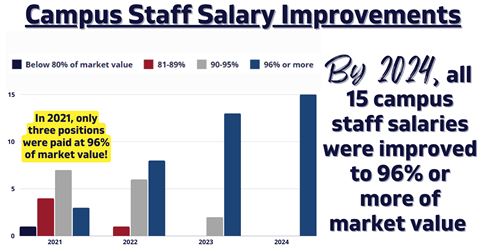

Even with the constrained budgets, MISD has worked to make improvements to teacher pay and now ranks no lower than fourth among neighboring districts. Campus staff salaries have improved as well, to 96% or more of market value.

LOOKING AHEAD

In the ongoing work to develop the 2024-25 school year budget, leaders are are working to reduce the district’s structural budget deficit. The budget priorities are staff compensation, school safety, ensuring excellent educational programs and enhanced professional development opportunities.

The district continues to explore ways to reduce expenses and increase revenue in the absence of any new funding from the state. MISD has strong legislative representation and will continue to work collaboratively with them to address funding. The district is also growing, which is better than the alternative.

The MISD Board of Trustees must formally adopt the 2024-25 budget prior the start of the start of the district’s July 1 fiscal year.

STRATEGIC PLAN REFRESH

Work is underway on the MISD “Pathway to Premier” Strategic Plan refresh. Task forces have been formed around the five district goals that were established in 2021:

Goal 1: Academic Achievement

Goal 2: School Safety

Goal 3: Finance & Operations

Goal 4: Human Capital

Goal 5: Communications & Customer Service

The task forces are comprised of MISD administrators, parents and community members. They have been working this spring to review and update the district’s current performance objectives, key performance indicators, and initiatives and strategies to ensure the strategic plan reflects the needs of MISD students and families. Task Force leaders will review feedback and recommend revisions to the current plan that will be reviewed by district leadership, then submitted for school board approval this summer.

The community is invited to review the district’s strategic plan progress and share feedback during this time of evaluation via the QR code below: